Most Scraped Websites of 2025

Last year, we launched the industry's first Most Scraped Websites report, which examined the platforms most widely utilized as data sources and identified key trends in publicly available data collection. This year's edition reveals how increased demand for AI tools, agents, and LLMs has driven companies to diversify their data sources, reshaping the landscape of most-targeted platforms.

Benediktas Kazlauskas

Last updated: Sep 09, 2025

9 min read

The data collection trends

Data scraping in 2025 looks completely different from what it did just a few years ago. Companies aren't just grabbing text from websites anymore. They want videos, images, and audio to train their AI solutions. The biggest change is that everyone's racing to collect data for AI training, which means they need way more diverse content than ever before.

Video content dominance

This year in our analysis, video-first platforms have claimed the top spots in our list. These sites are getting scraped more than ever before, which shows just how valuable video content has become for businesses trying to understand market trends and consumer behavior. Companies are also recognizing that video platforms are the go-to options for training various AI tools.

The rise of short-form video content, notably through TikTok's explosive growth, has created new data collection opportunities that simply didn't exist a couple of years ago. Businesses are now collecting video metadata, engagement metrics, and comments at growing scales to understand what captures audience attention in our fragmented media landscape.

The LLM training data explosion

The most transformative trend of 2025 has been the massive demand for training data to power LLMs (Large Language Models) and various AI solutions. Companies are racing to collect diverse, high-quality datasets to train everything from customer service chatbots to autonomous AI agents. This has fundamentally shifted scraping priorities:

- Multimodal content demand. AI systems need text, image, video, and audio data combined. Video-first platforms have become the best source for training multimodal AI models that can understand context across different media types.

- Real-time knowledge updates. AI agents require up-to-date information to make accurate decisions. This has driven continuous scraping of platforms like Google, Crunchbase, and ScienceDirect to keep AI systems updated with the latest information.

- Conversational data. More companies have started to implement AI chatbots and virtual assistants, creating massive demand for natural conversation patterns, product descriptions, and customer service interactions scraped from various eCommerce platforms and review sites.

"In 2025, outdated data is useless. LLMs and AI agents live on real-time, relevant information collected from various sources, including product reviews, the latest research papers, and trending content on community platforms. Companies are betting their future on having access to this kind of current, reliable data." – Vytautas Savickas, CEO at Decodo

Real-time eCommerce intelligence

In the past year, the typical eCommerce scraping use case has also changed. Shifting from simple price monitoring to advanced competitive intelligence systems that track product availability, customer reviews, shipping times, and even competitor marketing strategies in real time.

"We’ve seen an increasing demand for data from eCommerce platforms like Coupang, Amazon, and Walmart. Businesses are increasingly collecting more data from each platform, meaning these sites now play a bigger role in pricing strategies, product assortment decisions, and shaping customer experiences." – Gabrielė Verbickaitė, Senior Product Marketing Manager at Decodo.

Major changes from 2024 to 2025

The landscape of web scraping targets underwent dramatic shifts in 2025, primarily driven by the explosive growth in AI training data requirements and the emergence of multimodal AI systems. Companies have pivoted from traditional data collection to platforms offering rich, diverse content essential for training next-generation language models and AI agents.

New entrants to the top 10

Before revealing the complete list, here are the new websites that have made it into the top 10 this year:

- TikTok – essential for understanding cultural trends, viral content patterns, and social media sentiment analysis.

- YouTube – driven by explosive demand for video content and audio training data across industries.

- ScienceDirect – critical for accessing peer-reviewed research, scientific publications, and authoritative knowledge bases.

- Crunchbase – vital for business intelligence, startup tracking, investment analysis, and market research.

- Coupang – important for global eCommerce insights, Asian market intelligence, and cross-cultural consumer behavior.

- Airbnb – key for travel industry data, pricing optimization models, and hospitality market analysis.

Platforms that left the top 10

With the new targets climbing the list, a few websites dropped in position. Whether it’s due to the better alternative for data collection or the declining relevance of their content, their role in scraping priorities has noticeably decreased:

- TripAdvisor (previously #3) – dramatic change indicates that users are replacing review platforms with more comprehensive data sources that offer richer content variety and real-time insights.

- Craigslist (previously #5) – less relevant for modern LLM and AI agent training needs compared to other community forums, where the user activity is higher.

- Bing (previously #6) – businesses reduced data collection from this search engine and prioritized the dominant search engine for real-time data.

- Shopify (previously #8) – individual store scraping declined as businesses focus on major marketplace data.

- Lazada (previously #9) – replaced by bigger eCommerce marketplaces around the globe.

- Zillow (previously #10) – real estate data demand shifted toward broader business intelligence platforms.

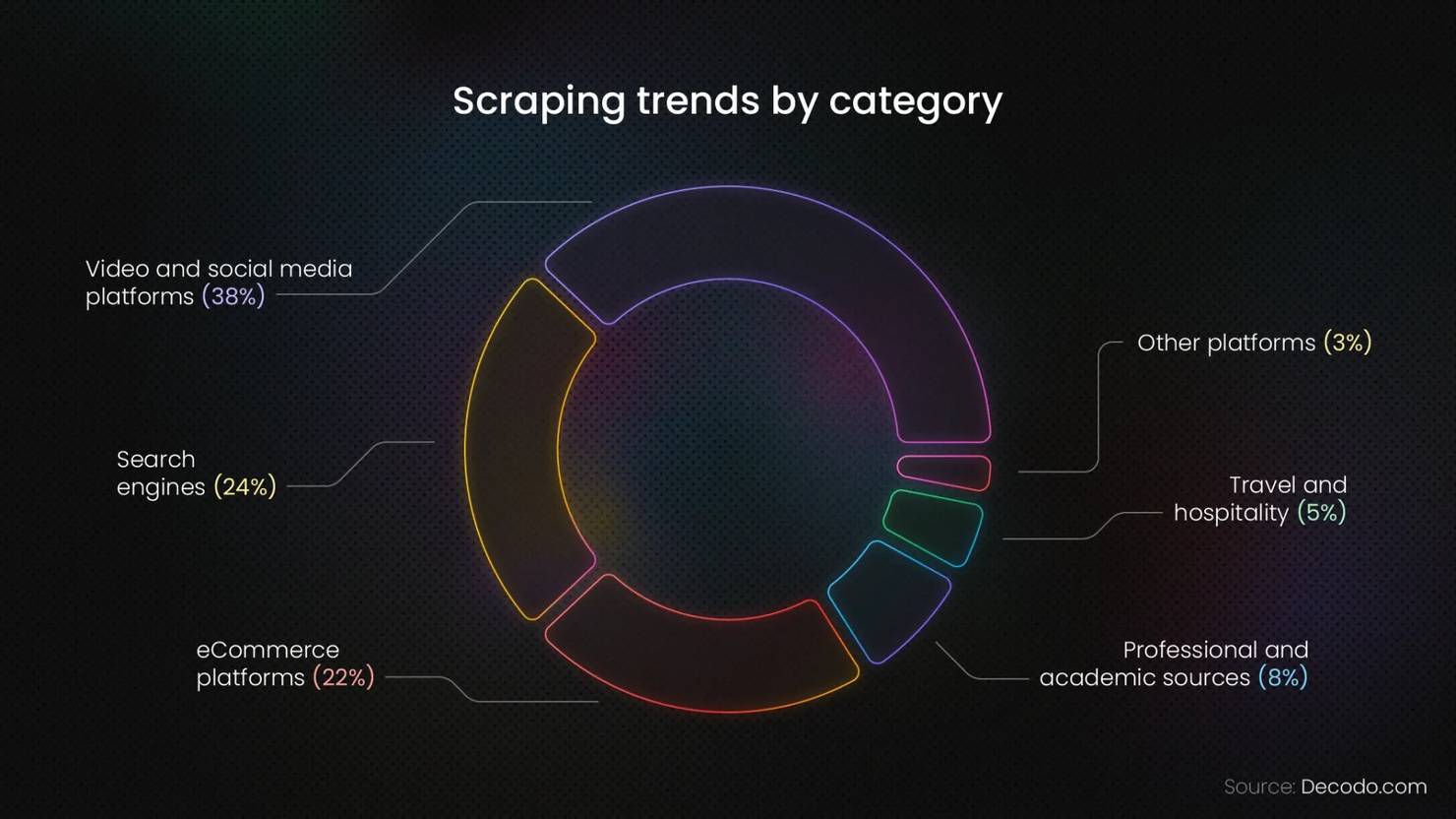

Scraping trends by category

Same as last year, eCommerce, search engines, and video-first social media remain the top categories, but their share has shifted as new platforms and data needs emerged in 2025.

Video and social media platforms (38%)

The combined scraping activity from YouTube, TikTok, and other video platforms now represents over a third of all scraping requests. This surge is driven by the demand for multimodal training data, where video, audio, and text are collected together.

These platforms also provide real-time signals on consumer behavior, trends, and product sentiment, making them invaluable for both AI development and market insights.

Search engines (24%)

Google maintains its position as a critical data source, though its relative share has decreased as businesses diversify their data collection strategies.

SEO professionals, advertisers, and AI developers continue to rely heavily on search result data for optimization and training purposes.

eCommerce platforms (22%)

Amazon, Walmart, Coupang, and eBay collectively account for nearly a quarter of all scraping activity. Dynamic pricing, inventory management, and competitive analysis drive the majority of this traffic.

Professional and academic sources (8%)

Platforms like ScienceDirect and Crunchbase have seen increased attention as businesses seek authoritative data sources for AI training and market research. This reflects a growing demand for high-quality, verifiable information to improve model accuracy.

At the same time, structured datasets from these sources help companies track industry developments and competitor strategies with greater confidence.

Travel and hospitality (5%)

Airbnb's presence in our top 10 reflects the ongoing importance of travel data for pricing optimization and market analysis. Hotels, airlines, and booking platforms are also frequent targets as businesses track availability, seasonal trends, and customer reviews. This information is increasingly used to benchmark competitiveness and adjust offerings in real time.

Miscellaneous websites and specialized platforms (3%)

Miscellaneous websites and specialized platforms make up the remaining scraping activity. These include niche forums, local marketplaces, and industry-specific portals that provide unique data points often unavailable on mainstream sites. While smaller in volume, this long-tail data is highly valuable for uncovering micro-trends and filling gaps in broader datasets.

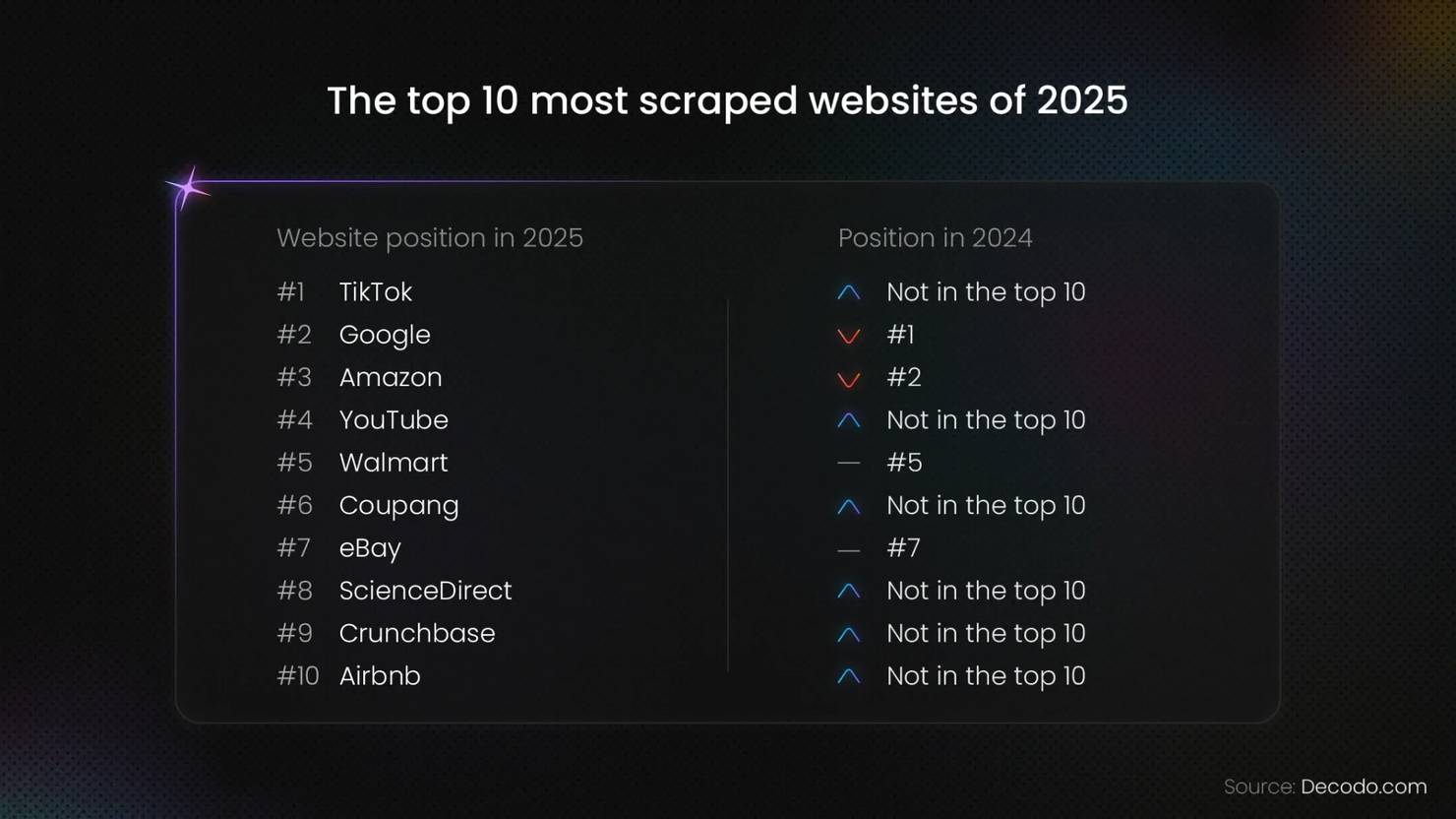

The top 10 most scraped websites of 2025

Now for the most revealing part of our analysis. The top 10 most scraped websites in 2025 show us exactly where companies are putting their focus compared to last year.

"AI tools, video-based models, and better data analysis have changed what websites businesses care about most. Some sites have become way more important, while others aren't getting as much attention anymore. Everyone's fighting harder than ever to get the best, most up-to-date information." – Gabrielė Verbickaitė, Senior Product Marketing Manager at Decodo.

#1 TikTok (previously not in top 10)

Traffic growth from 2024: 321%

TikTok jumped from not even being in the top 10 last year to becoming #1, representing the single biggest shift in our annual rankings. With over 1.5B active users and a unique algorithm-driven discovery system, this change reflects the AI industry's appetite for short-form video content and cultural trend analysis to train next-generation multimodal models.

Key data points collected by our users:

- Video content and metadata

- Hashtag trends

- User engagement metrics

- Audio/music usage data

- Creator analytics

- Comment sentiment

- Geographic trending data

#2 Google (previously #1)

Traffic growth from 2024: 84%

While Google has dropped from the top spot, it remains absolutely critical for a range of use cases. From analyzing SEO results and completing business intelligence tasks to AI training, the most popular search engine remains a central hub for data collection across various industries.

The platform processes over 13.7B searches daily, providing insights into global search trends, consumer behavior patterns, and real-time market demand across every industry and geography.

Key data points collected by our users:

- Search result rankings and featured snippets

- Local business listings and reviews

- Image search results

- News aggregation data

- Auto-suggest keyword data

#3 Amazon (previously #2)

Traffic growth from 2024: 151%

Amazon's slight drop to third place doesn't decrease its importance. Instead, it reflects the diversification of data sources businesses rely on. The platform remains the gold standard for eCommerce intelligence, from dynamic pricing and product assortment monitoring to customer reviews and market trend analysis.

Key data points collected by our users:

- Product listings and specifications

- Pricing data

- Customer reviews

- Seller information

- Inventory availability

- Best-seller rankings

- Sponsored product advertising data

#4 YouTube (previously not in top 10)

Traffic growth from 2024: 240%

YouTube's jump to #4 highlights AI companies' growing need for video and audio training data. With over 500 hours of content uploaded every minute and 2.7B monthly users, the platform has become a go-to source for businesses building smarter AI systems.

Companies are exploring YouTube's videos to train models that can understand speech, recognize objects, analyze facial expressions, and even pick up on cultural nuances from visual storytelling. The platform's mix of languages, accents, and content types gives AI developers exactly what they need to build systems that can actually understand how humans communicate through sight and sound, not just text.

Key data points collected by our users:

- Video metadata (titles, descriptions, tags, upload dates)

- Video and audio data

- Engagement metrics (views, likes, comments, shares)

- Channel analytics and subscriber count data

- Trending video identification

- Comment sentiment analysis

- Video transcript extraction

- Audio-visual correlation data

#5 Walmart (previously #4)

Traffic growth from 2024: 67%

Walmart’s slight drop in ranking reflects the platform’s continued importance while also showing the growing influence of video-first platforms. As America’s largest retailer, Walmart remains a critical source of data for market research, pricing strategies, and retail intelligence.

Walmart data also becomes more powerful when combined with insights from other eCommerce platforms such as Amazon, Target, or regional marketplaces. Cross-platform analysis helps fast-growing companies to track pricing competitiveness, monitor product availability across channels, and identify shifts in consumer demand.

Key data points collected by our users:

- Product availability and pricing

- Store location and inventory data

- Customer reviews

- Seller marketplace information

- Seasonal product trends

- Grocery and pharmacy data

- Local market pricing variations

#6 Coupang (previously not in top 10)

Traffic growth from 2024: 259%

Coupang’s entry into the rankings highlights the growing globalization of eCommerce data collection. As South Korea’s leading online retailer, Coupang offers valuable insights into consumer behavior, pricing strategies, and cross-border commerce in one of Asia’s most dynamic markets.

Key data points collected by our users:

- Product listings and Korean market preferences

- Pricing strategies

- Cross-border shipping data

- Local brand performance

- Category-specific trends

- Customer service metrics

- Mobile commerce patterns

#7 eBay (previously #7)

Traffic growth from 2024: 107%

eBay holds its position in the rankings, continuing to provide one of the richest sources of auction and marketplace data. As a platform built on both fixed-price and auction sales, eBay offers unique insights into pricing dynamics, consumer demand, and seller performance across categories and regions.

Key data points collected by our users:

- Auction results and final pricing

- Historical sales data

- Seller performance metrics

- Product condition and authenticity data

- International shipping patterns

- Category performance trends

- Buy-it-now versus auction preferences

#8 ScienceDirect (previously not in top 10)

Traffic growth from 2024: 148%

ScienceDirect's entry into the top 10 reflects the growing demand for high-quality, factually accurate data sources. Beyond academic research, businesses are increasingly turning to peer-reviewed content to support market analysis, product development, and strategic decision-making.

For technology developers, authoritative sources like ScienceDirect help ensure information reliability, while enterprises rely on these platforms for trusted insights into emerging technologies, scientific discoveries, and industry trends. This dual role, supporting both business intelligence and technological development, explains why ScienceDirect has become a primary platform for data collection in 2025.

Key data points collected by our users:

- Research paper abstracts and metadata

- Citation networks

- Author collaboration patterns

- Emerging research trends

- Technical terminology

- Geographic research distribution

- Publication timeline analysis

#9 Crunchbase (previously not in top 10)

Traffic growth from 2024: 132%

Crunchbase’s entry into the top 10 highlights the growing demand for reliable business intelligence data. Companies, investors, and analysts rely on the platform to track startups, funding activity, and industry shifts, making it a valuable resource for understanding global business dynamics.

Key data points collected by our users:

- Funding rounds and investment activity

- Company growth trajectories

- Founder and executive information

- Industry trend data

- Merger and acquisition activity

- Startup ecosystem health

- Geographic investment patterns

Crunchbase data supports everything from market research and competitive benchmarking to investment due diligence and corporate strategy. Paired with insights from other sources, it helps businesses identify growth opportunities, spot emerging players, and anticipate shifts in global markets.

#10 Airbnb (previously not in top 10)

Traffic growth from 2024: 18%

Airbnb’s ranking within the top 10 most scraped targets highlights the travel industry’s growing reliance on data. As one of the largest peer-to-peer accommodation platforms, Airbnb provides valuable information for understanding pricing, availability, and traveler preferences across global markets.

Additionally, Airbnb data is widely used by travel companies, hospitality groups, and analysts to refine pricing strategies, optimize inventory, benchmark against competitors, and track trending holiday destinations.

Key data points collected by our users:

- Property listings and availability

- Pricing trends across locations

- Host performance metrics

- Guest review sentiment

- Seasonal demand patterns

- Alternative accommodation growth

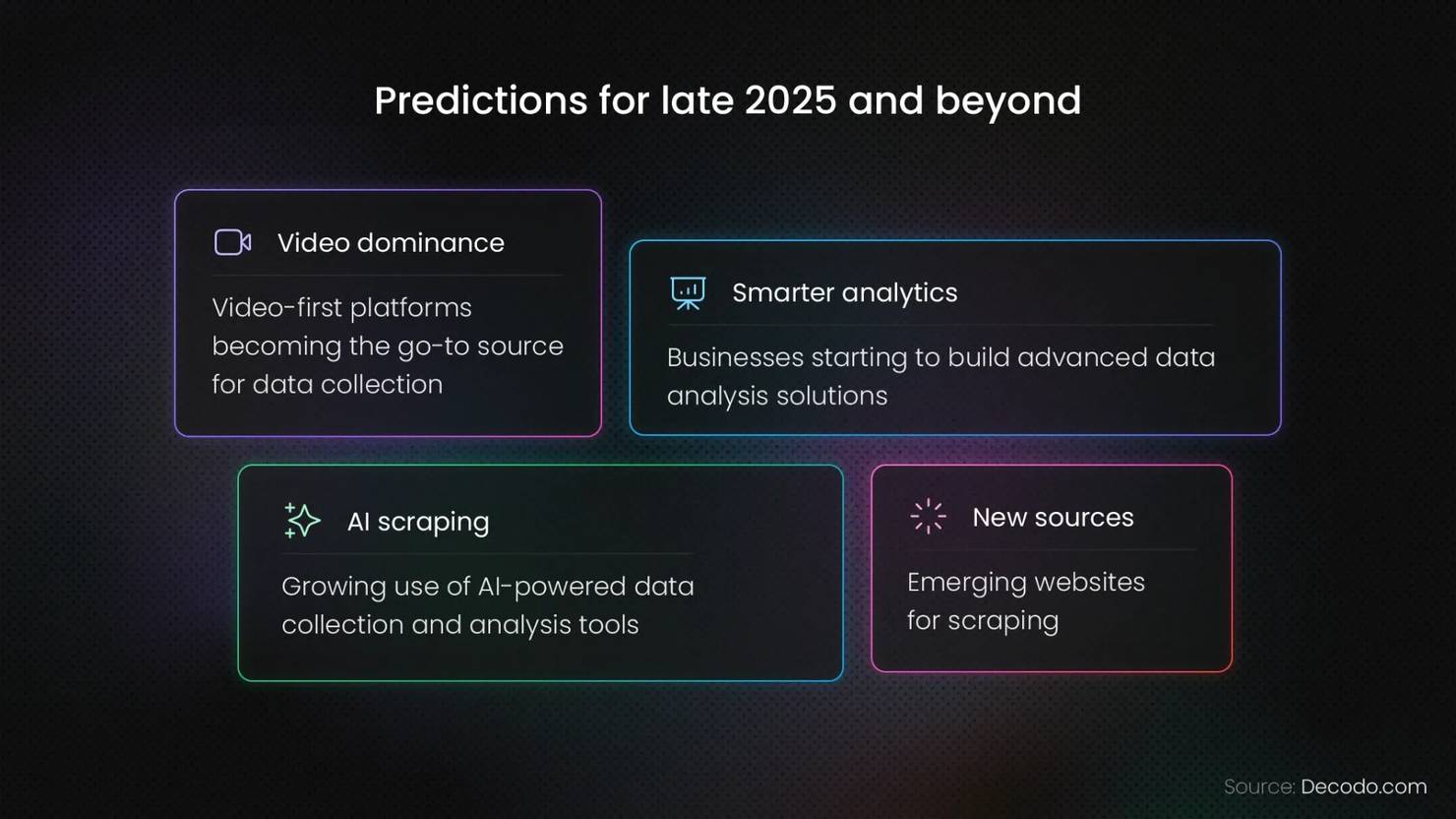

Predictions for late 2025 and beyond

The year is not over, and we’ll most likely see some new websites emerge as the go-to source for reliable, real-time data. But one thing will remain – the need for high-quality information that helps businesses stay competitive and make smarter decisions.

"We're seeing a clear move toward websites that have lots of different types of content instead of just basic info. The biggest reason for this shift is that everyone needs tons of varied, good-quality data to train AI chatbots, language models, and other smart tools. Companies operating in various industries are also realizing that the best insights come from mixing different kinds of content together – videos, text, images, and how people interact with certain platforms." – Vaidotas Juknys, Chief Commercial Officer at Decodo.

Platform changes

We expect video platforms to continue growing as businesses recognize the value of analyzing multimedia content. If TikTok moves more into eCommerce, that could make it even more popular for scraping. The need to train AI agents and language models will push more companies toward platforms with conversation data, user posts, and real-world interaction patterns.

Moving away from AI-generated analysis

As AI models like ChatGPT-5 become less transparent about their sources and cite fewer references, businesses will increasingly rely on collecting raw data themselves rather than trusting AI-generated summaries. Companies want to control their analysis process and understand exactly where their insights come from, driving more direct data collection from original sources.

Better technology

AI-powered scraping and parsing tools will become way more common, making it easier to pull out and analyze data faster. We'll see more specialized scraping tools built just for training AI systems and making machine learning models better. These tools will focus on gathering the diverse, contextual data that modern AI agents need to work well.

New data sources

Up-and-coming platforms in professional networking, fintech, and specialized industry forums might make it onto the most-scraped list once they get big enough and start producing valuable business insights. These platforms will be especially important for companies building AI agents that need to understand complicated human behaviors, work relationships, and niche market dynamics.

Bottom line

The 2025 list of most scraped websites reveals how drastically the data landscape has changed as businesses seek richer, more diverse content. TikTok’s rise to #1 reflects the growing value of multimedia content, while new entrants like YouTube, ScienceDirect, and Crunchbase prove companies need different data sources for consumer insights, research, and business intelligence. 6 completely new websites in the top 10 show how quickly priorities shift when businesses realize they need better quality, comprehensive data beyond traditional SEO and pricing information.

"Data might have been the new oil in 2006, but in 2025, it's the fuel that powers artificial intelligence. And AI systems have an appetite for fresh, diverse, and high-quality training data at unprecedented scale." – Gabrielė Verbickaitė, Senior Product Marketing Manager at Decodo.

Notably, the companies that thrive in this AI-driven environment will be those that can effectively collect, analyze, and transform diverse data sources into training datasets for their AI systems. Whether you're training a customer service chatbot, building an AI-powered pricing algorithm, or developing an autonomous research agent, the platforms on our 2025 list represent the essential data sources powering the AI revolution.

Disclaimer: data used in this article was aggregated from Decodo’s anonymized user base.

Unlock real-time data with Web Scraping API

Collect data from any website with 100+ ready-made scraping templates. Start your 7-day free trial today.

About the author

Benediktas Kazlauskas

Content Team Lead

Benediktas is a content professional with over 8 years of experience in B2C, B2B, and SaaS industries. He has worked with startups, marketing agencies, and fast-growing companies, helping brands turn complex topics into clear, useful content.

Connect with Benediktas via LinkedIn.

All information on Decodo Blog is provided on an as is basis and for informational purposes only. We make no representation and disclaim all liability with respect to your use of any information contained on Decodo Blog or any third-party websites that may belinked therein.