The Pricing Game Begins: How US Retailers and Buyers Prepare for Black Friday

As the biggest shopping festival of the year approaches, a dynamic shift occurs across thousands of online storefronts. Prices fluctuate by the hour, algorithms compete for consumer attention, and shoppers equip themselves with AI-powered price trackers and browser extensions. Black Friday has grown from a single-day shopping event into a months-long strategic tango between retailers and increasingly savvy consumers.

An exclusive analysis by web data company Decodo of 150K+ price observations across 37 major US eCommerce retailers, tracked throughout the year, reveals the complex strategies both sides deploy. The data paints a picture of a retail ecosystem in constant flux, where timing, category selection, and pricing algorithms can mean the difference between a genuine deal and clever marketing tricks.

Benediktas Kazlauskas

Last updated: Nov 13, 2025

9 min read

The acceleration of price changes

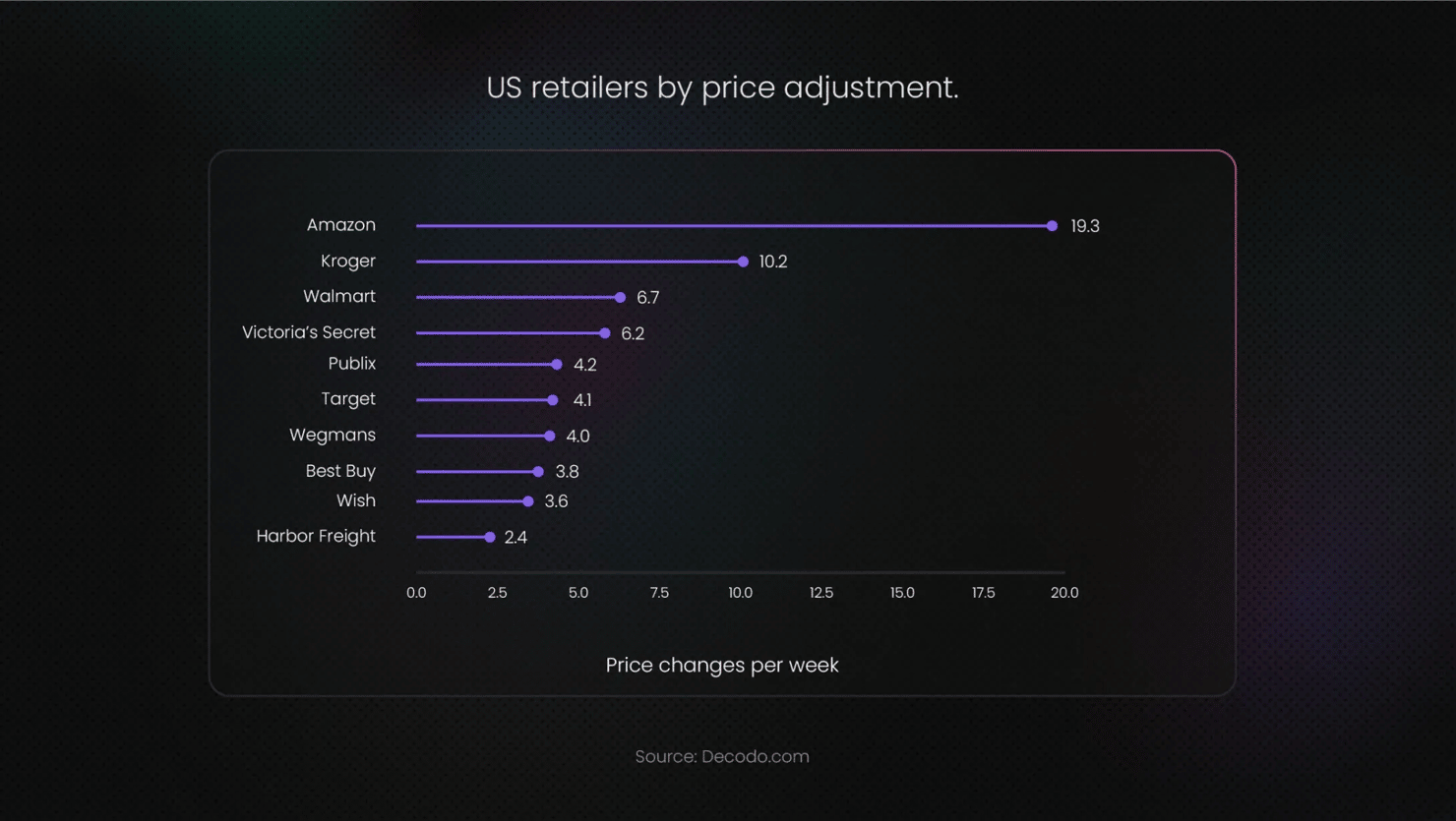

In the weeks leading up to Black Friday, US retailers increase their pricing activity around the most popular product categories. Data shows that across tracked products, prices change at dramatically different rates depending on the retailer and their strategy.

Amazon dominates with an ultra-aggressive pricing strategy, making approximately 19.3 price adjustments per week per product in the US market. This represents nearly three price changes daily, creating a constantly shifting landscape that challenges even the most dedicated deal hunters. With an average discount depth of 11.6% when prices drop, Amazon's strategy relies on high-frequency changes to capture consumer attention, though only about 27% of its price changes are actually discounts.

"What we're seeing now is urgency turned into a sales tactic," says Gabrielė Vitkė, Senior Product Marketing Manager at Decodo. "It's not just about discounts anymore. Retailers create momentum, keeping shoppers on edge so they feel they must buy immediately, often getting previous regular prices as limited-time deals after temporarily inflating them."

Kroger follows as the second most aggressive pricer with 10.2 weekly price adjustments per product, demonstrating that grocery retailers are adopting dynamic pricing strategies once reserved for electronics and fashion. The data reveals an interesting insight – while Kroger changes prices every 2 days on average, its 1.6% average discount depth across all changes ranks among the lowest tracked. However, when Kroger does discount, the depth averages 13.4%, it's just that only about 50% of price changes are actually discounts, with the other half being price increases. This constant up-and-down creates the illusion of deals while maintaining margins on grocery staples like pantry goods, beverages, and fresh produce.

Walmart maintains approximately 6.7 weekly price adjustments per product with a 3.8% average discount depth across all changes. Like Kroger, Walmart operates a balanced approach where 52% of changes are discounts and 48% are increases, cycling prices every 2.8 days. When Walmart does discount, however, the depth is substantial, averaging 45.3%, making it more rewarding than Amazon's frequent but shallow cuts. Walmart's strategy spans home goods, groceries, lawn & garden, and general merchandise, suggesting algorithmic pricing that responds to competitor moves while preserving strategic margin control.

Victoria's Secret emerges as a surprising pricing guru, adjusting prices 6.2 times per week with 3.7% average depth across all changes. Focusing primarily on women's apparel, bags, and footwear, Victoria's Secret demonstrates that fashion retailers can deploy high-frequency tactics traditionally associated with grocery and electronics. When discounts hit, they average an impressive 56.6%, the deepest among high-frequency retailers tracked. The balanced 52% discount with 48% increase split with changes occurring roughly every 7 days suggests a promotional calendar enhanced by algorithmic optimization, keeping intimate apparel and loungewear pricing competitive while maintaining brand positioning.

Publix (4.2 changes/week, 0.7% discounts), Target (4.1 changes/week, 0.9% discounts), and Wegmans (4.0 changes/week, 0.7% discounts) form the next tier, all hovering around 4 weekly adjustments but with modest discount depths below 1%.

Best Buy implements around 3.8 changes per week with 3.4% average discounts, while Wish shows a similar frequency at 3.6 changes per week with 1.9% discounts. Among mid-tier pricers, Harbor Freight made 2.4 changes per week with an average of 1.7% discounts.

Category-specific pricing strategies in the US market

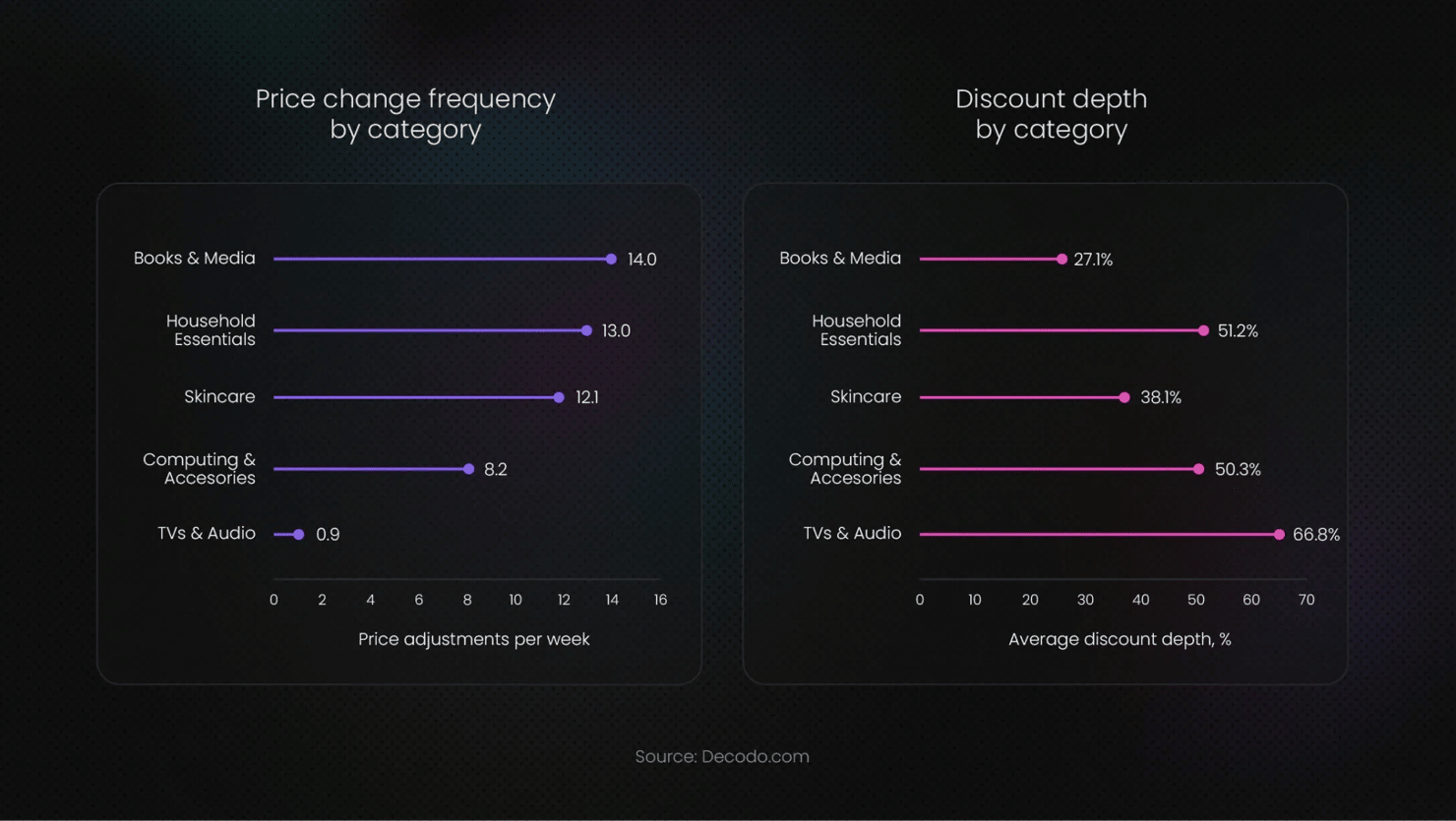

Not all product categories receive equal treatment in the pricing competition. Analysis of US market data reveals distinct patterns across retail segments, each with its own strategic logic.

Products that fall within the Books and Media category experience the most volatile pricing among US retailers, with over 14 price adjustments weekly. Despite frequent changes, average discount depths sit at a compelling 27.1%. The combination makes this category genuinely attractive for Black Friday shoppers, with retailers using rapid price changes to test market response and clear inventory.

Household essentials show surprisingly high pricing activity at 13 weekly adjustments, with dramatic 51.2% average discount depths when deals hit. This reflects retailers' use of loss leaders, products sold at significant discounts to drive traffic.

Skincare products rank third in pricing volatility with 12.1 weekly changes and 38.1% average discounts, as beauty retailers compete aggressively for holiday gift shoppers.

Computing and accessories represent a critical Black Friday category in the US market, with 8.2 weekly price changes and 50.3% average discount depths. This validates the traditional wisdom that electronics remain genuine Black Friday bargains, though the frequency is lower than expected, suggesting retailers save their best deals for specific moments rather than constant discounting.

TVs & audio, surprisingly, show relatively low frequency at just 0.9 weekly changes but deliver an impressive 66.8% average discount depth when deals appear. This aligns with strategic deep discounting rather than algorithmic price chasing.

Fashion post-Black Friday setup

The pricing data reveals a sophisticated strategy – most fashion retailers are deliberately restricting their pre-Black Friday discounting to preserve both margins and promotional impact. Several indicators support this:

Stable pricing predominates. 11-19% of products across fashion categories maintained completely fixed prices, while another 40-57% showed minimal variation (≤3 unique price points over 10 weeks).

October intensity, November calm. Total price changes surged in October (women's: 688 changes, men's: 247), then dropped sharply in early November (women's: 188, men's: 82), suggesting retailers are entering a "quiet period" before Black Friday.

Balanced price movements. The consistent 50/50 split between increases and decreases across all fashion categories indicates planned promotional cycles rather than reactive markdown pressure. Retailers raise prices after sales end, then discount again on schedule.

This restraint positions fashion retailers to maintain pricing power during the critical Black Friday-Cyber Monday period and, more strategically, to have fresh markdown inventory for post-holiday clearance (traditionally 50-70% off in late December-January). Retailers who aggressively discount throughout October-November leave themselves minimal room for post-Christmas clearances that drive high-volume, margin-sacrificing inventory turnover.

The takeaway for consumers – fashion deals before Black Friday appear largely artificial, prices rise and fall on promotional schedules that deliver modest 30-40% discounts available throughout the year. True value likely emerges either during the Black Friday weekend itself (when retailers release reserved inventory) or, more reliably, during post-Christmas clearances in late December through January, when retailers must clear seasonal inventory regardless of margin impact.

When US retailers drop prices

The analysis of US market data reveals interesting patterns about when prices drop throughout the week, though the findings challenge some conventional wisdom about "best days to buy."

Monday leads with the highest percentage of price changes being discounts (3.8%) and the strongest average discount depth (21.24%), supporting the traditional view that retailers launch weekly deals early in the week.

Tuesday follows closely with 3.9% of changes being discounts and 17.27% average depth, suggesting midweek momentum.

Thursday shows the highest volume of total price changes, though only 3.3% are discounts with 10.07% average depth, indicating more repricing activity than actual deal launches.

Saturday and Sunday show moderate discount rates (7.3-7.4%) with 8.11-8.14% average depths, capturing weekend browsing behavior but not showing exceptional deal activity.

The data reveals that 50% of price changes trend downward while the other half move upward across all days, indicating dynamic repricing rather than simple discount cycles. Prices don't just drop and stay low – they fluctuate based on inventory levels, competitor pricing, and demand signals throughout the day.

The evolution of price tracking technology

As retailers have accelerated their pricing changes, consumers have responded with increasingly sophisticated tracking tools. Browser extensions, mobile apps, and dedicated websites now monitor prices across thousands of retailers, alerting users to drops and tracking historical price data.

This consumer surveillance forces retailers to consider not just current competitor prices but also their own historical pricing. Savvy shoppers now verify whether "Black Friday deals" genuinely represent discounts or merely return to prices seen weeks earlier.

The analyzed Decodo’s US market data shows approximately 35% of tracked products demonstrate high price volatility, suggesting either overstocked items, discontinued lines, or strategic testing of price elasticity. Another 25% show medium volatility, while 40% maintain stable pricing, indicating products where discounting proves unprofitable or demand remains strong enough to avoid promotions.

"Informed consumers are changing the game," observes Vaidotas Juknys, Chief Commercial Officer at Decodo. "Retailers can't simply hike up prices and slash them anymore. The historical data is too accessible. The real Black Friday deals come from retailers absorbing margin hits or clearing excess inventory, not price manipulation."

The role of AI and algorithms

Modern pricing strategies rely heavily on machine learning algorithms that process vast quantities of data to optimize pricing decisions. These systems consider competitor prices, historical sales data, current inventory levels, predicted demand, shipping costs, and dozens of other variables.

The US market data suggests algorithmic pricing is becoming more sophisticated among major retailers. The controlled volatility patterns observed, where Amazon makes 19+ weekly changes while maintaining predictable discount depths, indicate algorithms testing boundaries while avoiding customer confusion or regulatory scrutiny.

Retailers using algorithmic pricing show higher discount cadences but also more precise targeting. Rather than blanket discounts across categories, these systems identify specific products where price reductions will maximize revenue, even if margins on those items temporarily suffer.

"The algorithms aren't just lowering prices randomly. They're identifying products where a 15%discount might increase unit sales by 40%, creating net positive revenue outcomes. The math behind these decisions is incredibly sophisticated," – Gabrielė Vitkė, Senior Product Marketing Manager at Decodo, noted.

Bottom line

The real winners in the highly dynamic pricing landscape are those who understand the game, armed with data and patience to distinguish genuine value from cleverly marketed illusions. An analysis of 150,688 price observations across 37 major retailers shows that Black Friday is no longer just about timing your purchase, it’s about reading the patterns.

"Black Friday has become less about when you buy and more about whether you know how to read the patterns," noted Vaidotas Juknys, Chief Commercial Officer at Decodo.

Ultimately, the pricing dynamics that kick off every fall aren’t merely about clearing inventory or chasing deals. They reflect the transformation of modern retail: a data-driven, algorithm-powered world where every price tag tells a story of strategy.

Try all-in-one Web scraping API

Unlock real-time data from any website with a 7-day free trial.

About the author

Benediktas Kazlauskas

Content Team Lead

Benediktas is a content professional with over 8 years of experience in B2C, B2B, and SaaS industries. He has worked with startups, marketing agencies, and fast-growing companies, helping brands turn complex topics into clear, useful content.

Connect with Benediktas via LinkedIn.

All information on Decodo Blog is provided on an as is basis and for informational purposes only. We make no representation and disclaim all liability with respect to your use of any information contained on Decodo Blog or any third-party websites that may belinked therein.