How Post-Black Friday Price Swings Are Changing US Holiday Shopping

The morning after Black Friday, Sarah Chen had buyer's remorse. She'd grabbed a skincare set from Ulta on Friday for $14, thinking she'd scored a deal. But by Monday, she watched the same product drop to $12. By Wednesday, it hit $11. She'd paid 27% more than patient shoppers who waited just three days.

An exclusive analysis conducted by web data company Decodo, with data collected starting from Black Friday (28 November 2025) through early December 2025, exposed a phenomenon where the days after Black Friday matter as much as the day itself. For millions of shoppers, the question isn't whether they got a good deal on November 28. It's whether they should have waited until December.

Elena Dambrauskaite

Last updated: Dec 05, 2025

5 min read

The 26% nobody talks about

Out of over 430 tracked products, 111 items (1 in 4) got cheaper after Black Friday ended. The average additional discount: 34.55%.

But the reality is that post-Black Friday price movements split sharply by category, and most went the opposite direction.

"What's interesting is the divergence," says Gabrielė Vitkė, Senior Product Marketing Manager at Decodo. "For most categories, Black Friday remains the lowest price. But for a meaningful subset, the days after Black Friday matter just as much as Friday itself."

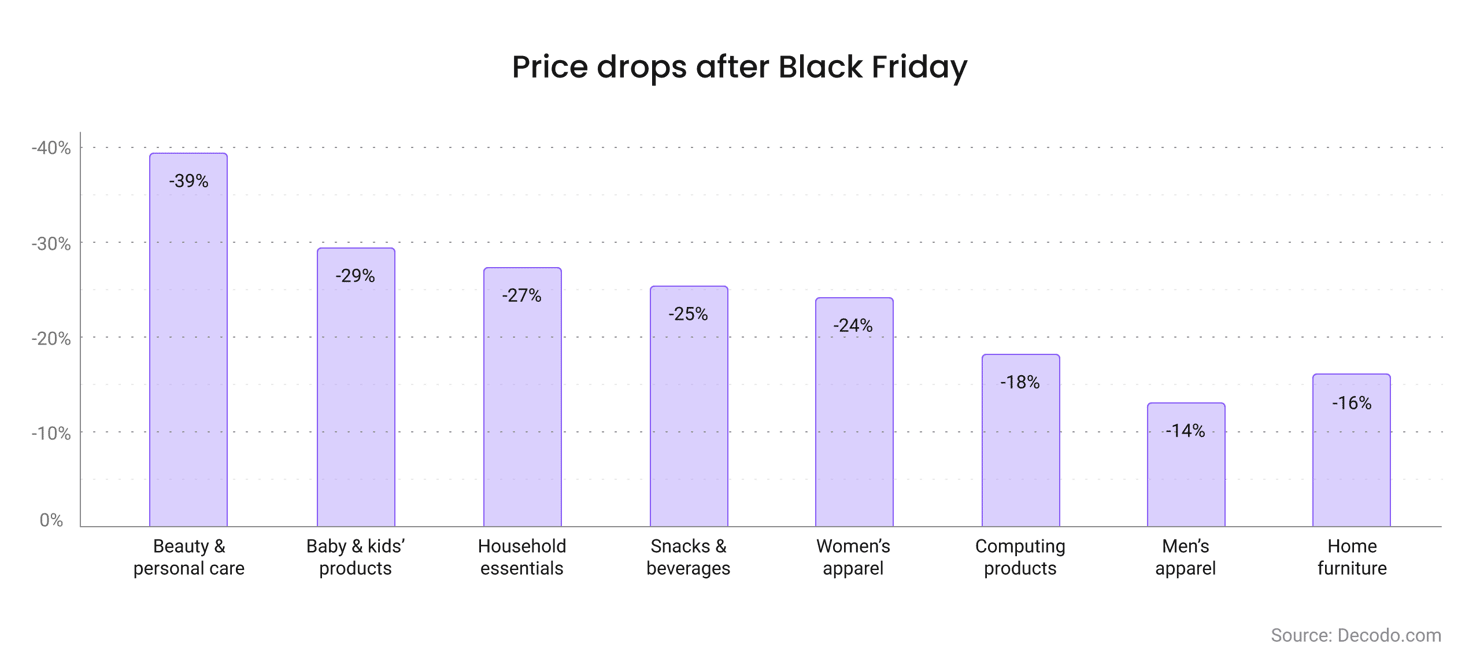

The categories that saw the most post-Black Friday price drops were concentrated in specific sectors. Beauty and personal care led the way, with 39% of fragrance and body products getting cheaper and 36% of skincare dropping further (averaging 13% additional savings). Kids and baby items followed, with 29% continuing to fall.

Household essentials saw mixed results. While 27% of household products dropped more and 25% of snacks and beverages fell further, grocery staples like meat, seafood, and pantry goods didn't drop at all.

Fashion and electronics mostly held or increased. Only 24% of women's apparel got cheaper (while 17% actually increased). Just 18% of computing products dropped, with 35% increasing instead. Men's apparel saw minimal drops – only 14% got cheaper, while 32% increased. Home furniture was similarly mixed, with 16% dropping but 21% increasing.

Some categories never dropped after Black Friday. For example, pet supplies didn't get cheaper across every retailer tracked – 67% actually increased, whereas TVs and audio stayed flat or rose, with 33% increasing.

The pattern reveals two distinct retail strategies: beauty retailers and personal care brands treated Black Friday as the start of extended clearance sales. But electronics, grocery staples, and pet supplies used Black Friday as a 24-hour floor price, with many items returning to higher prices within days.

What happens after the Black Friday discounts vanish?

The speed of price recovery varies dramatically by category.

Electronics and computing recovered fastest, meaning Black Friday discounts disappeared within days. 35% of computing products increased in price after Black Friday, while only 18% continued to drop. Home appliances followed similar patterns, with 43% of products jumping back up to higher prices versus just 14% falling further.

Men's apparel snapped back aggressively. 32% of products increased in price post-Black Friday, while only 14% got cheaper.

Tools and hardware showed the same trend, with 31% increasing and just 6% dropping. Even women's apparel, though more balanced, saw 17% of products increase compared to 24% that continued falling.

"The price reset tells you the retailer's true intention," explains Gabrielė Vitkė. "Fast snapback means they never planned to sustain the discount. It was traffic bait. Slow or no price reset means they're genuinely trying to move inventory."

For shoppers, this creates narrow decision windows. Buy electronics, computing, men's apparel, or tools on Black Friday or risk paying more. Wait on beauty products, skincare, or kids' items, and you could save even more.

The regret economics

For the 111 products that dropped post-Black Friday, shoppers who waited saved an additional 34.55% on average. But this headline number obscures the variance.

A Walmart home furniture item priced at $91 on Black Friday dropped to $44 within days – a 51% additional discount. Macy's women's apparel fell from $102 to $55 (47% drop). An Amazon household item went from $113 to $63 (45% savings). These were the wins for patient shoppers.

But the other side of regret economics proved costly. Macy's footwear that dropped 31% on Friday rose 66% by the following week and computing products that seemed like deals snapped back fast. Shoppers who waited, thinking prices would drop further, instead watched most categories return to pre-sale levels or climb higher.

"It's not gambling if you know the odds," says Vaidotas Juknys, Chief Commercial Officer at Decodo. "The problem is that most shoppers don't know fragrance has 39% odds of dropping further, while TVs have 0% odds. They're making decisions with incomplete information."

The data reveals clear regret risk profiles.

Regret risk by category

High regret risk if bought during Black Friday (35-40% got cheaper after):

- Fragrance and body products (39% got cheaper, 23% increased)

- Skincare (29% got cheaper, 14% increased)

- Kids and baby items (36% got cheaper, 21% increased)

Medium regret risk if bought during Black Friday (20-30% got cheaper after):

- Household essentials (27% dropped more, 27% increased)

- Snacks and beverages (25% got cheaper, 8% increased)

- Women's apparel (24% got cheaper, but 17% increased)

Low regret risk if bought during Black Friday (less than 20% got cheaper):

- Computing accessories (only 18% got cheaper, 35% increased)

- Men's apparel (only 14% got cheaper, 32% increased)

- Home furniture (only 16% got cheaper, 21% increased)

- Tools (only 6% got cheaper, 31% increased)

Zero regret risk – Black Friday was the best price:

- Pet supplies (0% got cheaper, 67% increased)

- TVs and audio (0% got cheaper, 33% increased)

- Meat and seafood (0% got cheaper, 33% increased)

- Pantry staples (0% got cheaper)

The 74% comfort

Despite the complexity, one number offers comfort: 74% of products hit their lowest price on Black Friday itself. For shoppers who don't want to track prices, monitor alerts, or play the post-sale waiting game, buying on Black Friday remains a solid strategy.

Shoppers might miss some deals and overpay occasionally. But they’ll get a legitimate discount 74% of the time, and they’ll avoid the regret of watching doorbusters sell out while they wait for prices that might never drop.

The trade-off is clear: certainty costs money. In 2025, that cost averaged 34.55% on the items that dropped further. Whether that's worth the effort of tracking prices depends entirely on how much a shopper is spending and how much their time is worth.

For a $30 item, saving an additional $10 might not justify the effort. For a $2,000 item, saving $700 absolutely does. The math scales with purchase size.

What should shoppers expect in December?

Historical patterns suggest prices stabilize by mid-December as retailers shift focus from margin optimization to volume clearing.

By December 10, most repricing settles into more predictable patterns. Discounts might be smaller than Black Friday peaks, but certainty increases dramatically. For risk-averse shoppers, this creates an interesting trade-off: accept 5-10% smaller discounts in exchange for knowing the price you see today will likely be the price tomorrow.

"The hangover period is when retailers test price elasticity," explains Gabrielė Vitkė, Senior Product Marketing Manager at Decodo. "They want to know: how much can we raise prices before demand falls? By mid-December, they've answered that question and pricing stabilizes."

Some products (particularly electronics, toys, and seasonal clothing) could see new discounts closer to Christmas as retailers work to clear leftover stock.

Tools for the new reality

The shift to post-sale price volatility has created demand for tools that didn't exist five years ago. Price-tracking browser extensions, historical price databases, automated alert systems – these moved from "power user" territory to essential shopping infrastructure.

Decodo provides advanced web scraping and proxy services that empower both shoppers and businesses to monitor prices in real time, analyze competitor pricing strategies, and automate data collection at scale.

“The data shows shoppers without the right tools are consistently overpaying in dynamic pricing environments,” notes Vaidotas Juknys. “Our solutions help users access accurate, up-to-date pricing data so they can make smarter buying decisions and avoid leaving savings on the table.”

Bottom line

As December progresses, the post-Black Friday hangover will fade. Prices will stabilize, promotions will become predictable, and the chaos of late November will give way to the more familiar patterns of holiday retail.

But the data suggests this isn't a temporary phenomenon. Post-sale price volatility is the new normal. The days after Black Friday matter as much as Black Friday itself. And shoppers who ignore this do so at their own financial risk.

The promise of Black Friday was always simple: one day, best prices, done. That promise is now 74% accurate. For the remaining 26%, the real shopping begins when Black Friday ends.

Try all-in-one Web scraping API

Unlock real-time data from any website with a 7-day free trial.

About the author

Elena Dambrauskaite

Content Manager

Elena is a content manager with 4 years of experience helping international startups and established enterprises communicate complex ideas with clarity and impact. With professional experience across borders, she brings a global perspective to every project and is passionate about making technology accessible, engaging, and human through content that connects with diverse audiences.

Connect with Elena via LinkedIn

All information on Decodo Blog is provided on an as is basis and for informational purposes only. We make no representation and disclaim all liability with respect to your use of any information contained on Decodo Blog or any third-party websites that may belinked therein.